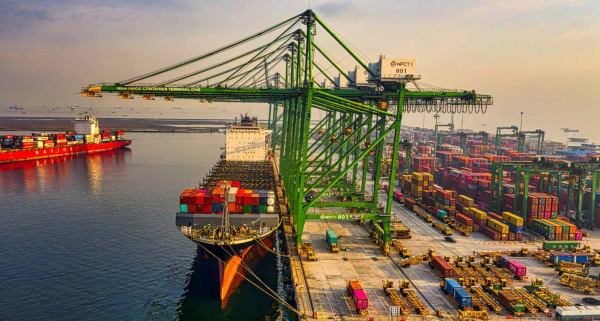

The latest shipping data shows that efforts to speed up the flow of goods around the world have yet to resolve supply chain bottlenecks caused by surging demand for retail goods and pandemic related lockdowns.

In ocean freight, transpacific rates increased with an increase in demand post Lunar New Year.

In 2022, Tight container capacity and port congestion also mean that longer-term rates set in contracts between carriers and shippers are running at an estimated 200 per cent higher than a year ago, signaling elevated prices for the foreseeable future.

The spot rate for a 40-foot container to the United States from Asia topped US$20,000 (S$26,970) last year, including surcharges and premiums, up from less than US$2,000 a few years ago, and was recently hovering near US$14,000.

International shipping rates are at all-time highs. Along the China-EU shipping lane, TIME reports: “Transporting a 40-foot steel container of cargo by sea from Shanghai to Rotterdam now costs a record $10,522, a whopping 547% higher than the seasonal average over the last five years.” Between China and the UK, the cost of shipping has gone up by over 350% in the past year.

“While Europe has experienced much less port congestion compared to major U.S. ports, the congestion in southern California causes schedule disruptions and capacity constraints that have global consequences,” Project44 Josh Brazil said.

The journey time from China’s northern Dalian port to the major European port of Antwerp rose to 88 days in January from 68 days in December because of a combination of congestion and waiting time. This compared with 65 days in January 2021, analysis from logistics platform project44 showed.

Transit time from Dalian to the eastern British port of Felixstowe, which has seen some of the biggest backlogs in Europe, reached 85 days in January from 81 in December, versus 65 days in January 2021

Josh Brazil of project44 said it would take “several years to return to pre-pandemic supply chain stability”.

Maersk said high shipping costs had prompted more customers to prefer longer-term contracts instead of relying on the securing container capacity in the spot market.

“In the extraordinary market situation last year, we’ve had to prioritize customers who sought a longer-term relation with us,” Skou said. For those relying on the spot market, “the last year has not been fun.”

container shipping group Maersk (MAERSKb.CO) and freight forwarder DSV (DSV.CO), Two top European shippers warned on Wednesday freight costs were likely to remain high well into this year, offering no relief to customers including the world’s biggest retailers, though they said bottlenecks should ease later in the year.

Are you ready for the challenge of shipping?

Post time: Feb-22-2022